Executive Summary:

In today’s volatile and complex economic environment, Chief Financial Officers (CFOs) are under immense pressure to simultaneously drive profitability, ensure operational resilience, and support business growth. Achieving this trifecta requires the integration of finance with other business functions and a commitment to real-time, insight-driven decision-making. Oracle offers a unified cloud platform that connects finance, HR, operations, and more — delivering real-time analytics, intelligent automation, and predictive insights. This white paper explores the top challenges facing CFOs today and demonstrates how Oracle’s integrated cloud solutions empower CFOs to overcome them, enabling strategic agility, optimizing costs, mitigating risk, and paving the way for long-term value creation.

Navigating the New Mandate for CFOs

CFOs today are expected to go far beyond traditional financial stewardship. They are tasked with being strategic partners to the CEO, driving data-informed decisions, and proactively managing risk. Amid global economic uncertainty, supply chain disruptions, and rapid market changes, finance leaders must:

-

Provide accurate, real-time insights

-

Balance cost optimization with growth investments

-

Enable workforce agility and cross-functional alignment

-

Mitigate compliance and operational risks

-

Drive long-term value through strategic initiatives

To meet these demands, finance leaders need modern technologies that support agility, resilience, and innovation.

Top Challenges Facing CFOs and Oracle’s Solutions

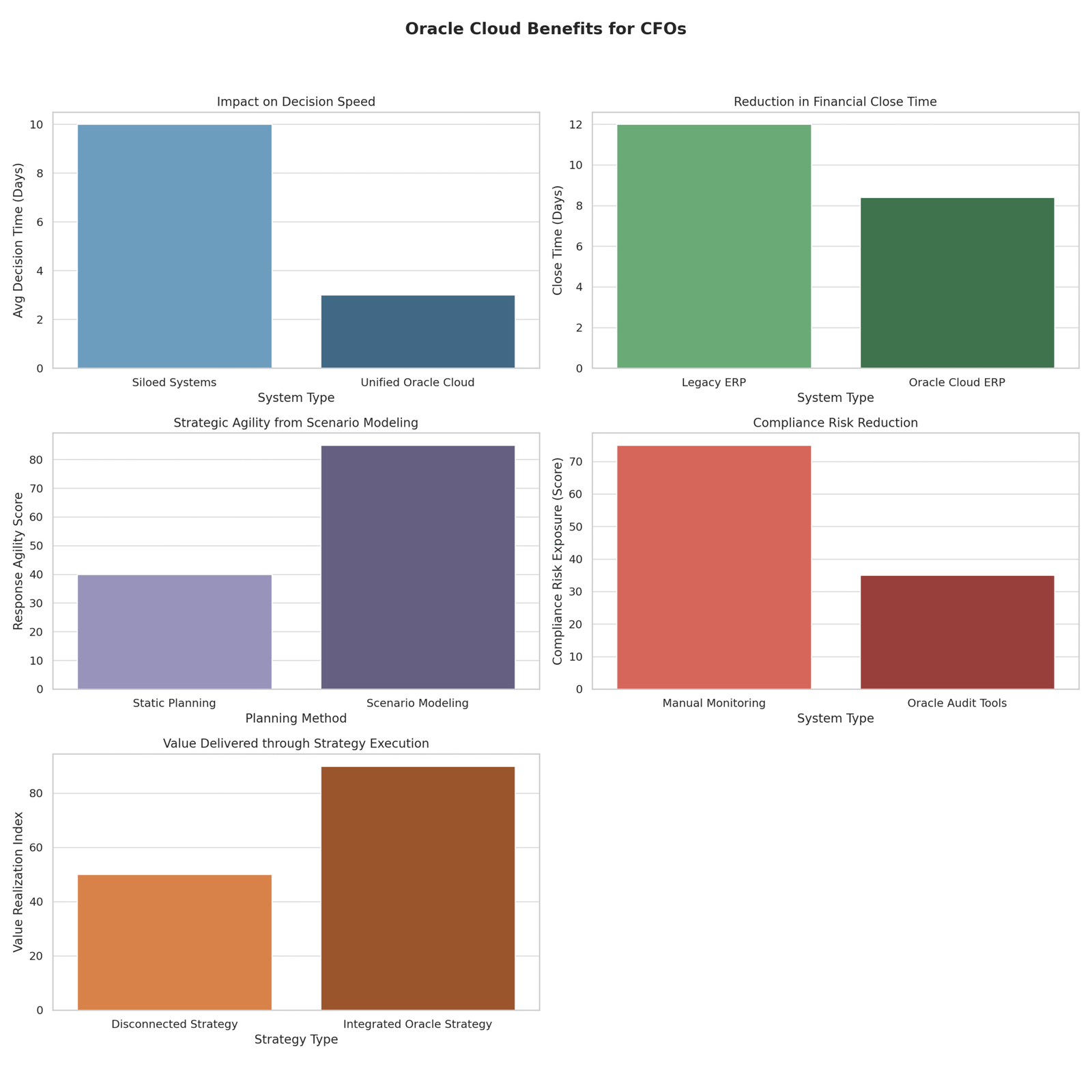

Lack of Real-Time, Connected Data

-

The Challenge: Disconnected systems and data silos hinder timely analysis and decision-making.

-

Oracle’s Solution: Oracle Fusion Cloud ERP integrates data across finance, HR, supply chain, and operations in real time. CFOs gain a single source of truth and actionable insights through embedded analytics and AI-driven forecasting.

Manual Processes and Inefficiency

-

The Challenge: Manual financial closes, reconciliations, and reporting reduce productivity and increase errors.

-

Oracle’s Solution: Oracle automates core finance processes, reducing close times by up to 30%. AI and ML streamline tasks such as invoice processing, journal entries, and variance analysis.

Limited Agility in Financial Planning

-

The Challenge: Static budgets and inflexible planning limit responsiveness to changing conditions.

-

Oracle’s Solution: Oracle Cloud EPM enables rolling forecasts, scenario modeling, and driver-based planning — supporting agile, continuous planning aligned with enterprise strategy.

Rising Risk and Compliance Burden

-

The Challenge: Managing regulatory changes, cyber risks, and fraud is becoming more complex.

-

Oracle’s Solution: Built-in controls, audit trails, and real-time monitoring help CFOs meet compliance standards, detect anomalies, and reduce financial risk exposure.

Pressure to Drive Profitable Growth

-

The Challenge: CFOs must balance margin protection with investments in innovation, M&A, and market expansion.

-

Oracle’s Solution: With comprehensive insights and integrated planning, Oracle helps finance leaders evaluate investment trade-offs, measure ROI, and support M&A due diligence with confidence.

Strategic Benefits of Oracle for CFOs

-

Enterprise-Wide Visibility: Unified data across departments for end-to-end decision-making.

-

Accelerated Time-to-Close: Automated processes streamline the close, improve accuracy, and free finance teams for strategic tasks.

-

Predictive, AI-Driven Insights: Embedded analytics and machine learning enable forward-looking decision-making.

-

Continuous Planning: Responsive planning capabilities empower proactive resource allocation.

-

Future-Proof Platform: Scalable, secure, and regularly updated with the latest innovations.

Conclusion: Empowering the Modern CFO

Oracle provides CFOs with a transformative cloud platform that turns finance into a strategic powerhouse. By integrating finance with HR, operations, and other business units, CFOs can make faster, better-informed decisions that optimize profitability and reduce risk. Real-time data access, automation, and AI-driven insights allow finance leaders to lead with agility and confidence in an unpredictable world.

Call-to-Action

To navigate complexity and lead with confidence, today’s CFOs need more than incremental improvements — they need a transformative Oracle partner. Contact CushySky to discover how we can help you harness Oracle’s powerful cloud solutions to unlock strategic growth, reduce operational risk, and future-proof your finance organization.

Let’s talk about how we can help you lead the future of finance.